- Most Improved: Napleton Automotive Group Improved Ranking from Last to Second with 14-point Gain Over 2023 Pied Piper Study Results

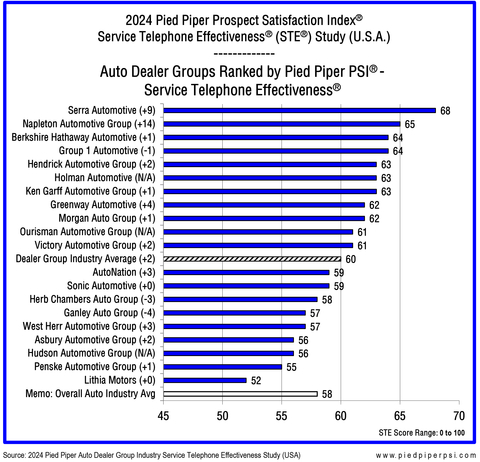

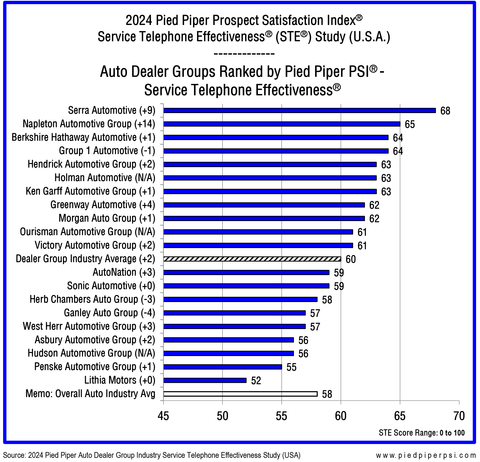

Auto Dealer Groups Ranked by Pied Piper PSI® Service Telephone Effectiveness® (STE®)

September 09, 2024 12:01 AM Eastern Daylight Time

MONTEREY, Calif.–(BUSINESS WIRE)–Serra Automotive was ranked first out of 20 auto dealer groups in Pied Piper’s 2024 PSI® Service Telephone Effectiveness® (STE®) Study, which measured the efficiency and quality of service telephone calls from a customer’s objective of quickly and easily setting up a service appointment. Following Serra Automotive in the rankings were Napleton Automotive Group, Berkshire Hathaway Automotive and Group 1 Automotive.

“Customers who encounter challenges when scheduling service may choose to go to a different dealership or independent repair shop, or they may decide to replace their vehicle as well as their dealership.”Post this

“Successful service departments value customer loyalty, and a customer’s attempt to schedule service is the first interaction that fosters this loyalty,” said Fran O’Hagan, Pied Piper CEO. “Customers who encounter challenges when scheduling service may choose to go to a different dealership or independent repair shop, or they may decide to replace their vehicle as well as their dealership.”

The 2024 Pied Piper PSI®-STE® Auto Dealer Group Study (U.S.A.) was conducted between January 2024 and July 2024 by phoning the service departments at every dealership location owned by each of the twenty dealer groups studied. STE scores range from 0 to 100 and are calculated from a mix of individually weighted measurements that support the customer’s mission of quickly speaking with a service representative who can schedule a service appointment within a reasonable amount of time. Sixty-two percent of the total score is determined by efficiency measurements, while 38 percent of the total score is determined by quality measurements, where dealerships provide a proactively helpful experience that goes above and beyond the customer’s basic expectations.

The 2024 dealer group industry average STE score was 60, an increase of two points from last year. The average time for service customers to reach a service advisor dropped from 82 seconds in 2023 to 57 seconds in 2024, and service appointments averaged 4 days out, one day sooner on average than last year. Not all measurements improved. “Mission Failure,” where a service customer hung up the phone having failed to schedule an appointment (for reasons such as no response, endless hold, lost in phone tree, no availability, etc.), increased from 11 percent of the time to 13 percent of the time.

Serra Automotive scored the highest out of all dealer groups included in the study, with a score of 68, up nine points vs last year. Serra had the second highest rate of “Mission Acceptable” service calls (reached a service advisor within one minute and scheduled an appointment less than one week out), 76 percent of the time on average, compared to the industry average of 53 percent of the time. At the same time, Serra had the lowest rate of “Mission Failure” calls, occurring less than one percent of the time, while the industry averaged 13 percent of the time. Serra also had the lowest average number of seconds to reach a service advisor at 31 seconds, versus the industry’s overall average time of 57 seconds. The overall industry had customers placed on hold over two minutes at a rate of 13 percent of the time while at the same time no Serra Automotive callers were placed on hold over two minutes. Lastly, Serra automotive dealerships averaged three days out for a service appointment, less than the industry average rate of four days out.

The dealer group with the greatest improvement was Napleton Automotive Group, which achieved a 14-point increase in average STE score compared to last year, and achieved a study ranking of second, compared to finishing last in the 2023 rankings. Compared to their 2023 measurements, Napleton cut the average customer wait time to speak with a service advisor from 70 seconds to 40 seconds, and increased their rate of overall “Mission Excellent” calls from 30 percent of the time to 62 percent of the time. Over the same timeframe, Napleton also reduced their average service days out from five days in 2023 down to three days in 2024.

Compared to the overall auto industry, the large dealer groups measured in the study performed two points better, with an average score of 60 vs the 2024 overall auto industry average score of 58. Thirteen of the 20 dealer groups scored above the 2024 overall auto industry average score, while only five of the 33 automotive brands scored higher than the 2024 dealer group industry score.

The following are additional examples of performance variation by dealer group for measurements from the study:

- “Mission Failure” How often did a customer hang up their phone having failed to schedule a service appointment?

- Less than 5% of the time on average: Serra Automotive Inc., Holman Automotive

- More than 15% of the time on average: Penske Automotive Group, Hudson Automotive Group, Lithia Motors

- “Mission Acceptable” How often was a customer able to speak with a service advisor within one minute and schedule a service appointment within one week?

- More than 65% of the time on average: Morgan Auto Group, Serra Automotive, Greenway Automotive, Napleton Automotive Group, Berkshire Hathaway Automotive

- Less than 45% of the time on average: Ganley Auto Group, Ken Garff Automotive Group, Penske Automotive Group, West Herr Automotive Group

- “Mission Excellent” How often did a customer experience a frictionless and high-quality experience, with an STE score of 70+?

- More than 55% of the time on average: Napleton Automotive Group, Berkshire Hathaway Automotive

- Less than 35% of the time on average: Ganley Auto Group, Penske Automotive Group, West Herr Automotive Group

- How often was a customer placed on hold for more than two minutes?

- Less than 5% of the time on average: Serra Automotive, Hudson Automotive Group, Victory Automotive Group

- More than 15% of the time on average: Lithia Motors, AutoNation, Asbury Automotive Group Inc., Penske Automotive Group

- How many days out was the first available service appointment?

- Less than 3 days on average: Group 1 Automotive, Greenway Automotive, Morgan Auto Group, Ourisman Automotive Group

- More than 5 days on average: Ken Garff Automotive Group, Holman Automotive, West Herr Automotive Group

- How often was a customer asked if they were experiencing any other issues?

- More than 60% of the time on average: West Herr Automotive Group, Ken Garff Automotive Group, AutoNation

- Less than 30% of the time on average: Greenway Automotive, Morgan Auto Group, Ourisman Automotive Group, Hudson Automotive Group

A better service customer experience begins with dealerships understanding what actually occurs during customer calls, which can often be a surprise. “Paying attention to service phone calls is well worth the effort,” remarked O’Hagan. “Customers who find it simple and easy to schedule service are on the path to higher loyalty, not just for future service needs but also when purchasing a new vehicle.”

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps improve the omnichannel sales & service performance of retailers, by determining fact-based best practices, then measuring and reporting performance. Pied Piper PSI industry studies have been conducted annually since 2007. Examples of other recent Pied Piper PSI studies are the 2024 Pied Piper PSI® STE® Auto Industry Study (Honda’s Acura brand was ranked first), the 2024 Pied Piper PSI® Internet Lead Effectiveness (ILE®) Auto Industry Study (Nissan’s Infiniti brand ranked first), and the 2024 Pied Piper PSI® STE® Powersports Industry Study (Triumph Motorcycles was ranked first). Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI process, go to www.piedpiperpsi.com.

This press release is provided for editorial use only, and information contained in this release may not be used for advertising or otherwise promoting brands mentioned in this release without specific, written permission from Pied Piper Management Co., LLC.

Contacts

Pied Piper

Ryan Scott

press@piedpiperpsi.com

(831) 648-1075

source link – https://www.businesswire.com/news/home/20240908960091/en

Leave a Reply